.png)

For example, the fee to deliver $50 to a Walmart in Mexico is $1.99. Payment options: Bank account, credit, debit or prepaid card, Poli, Interac, iDEAL, Soford, Google Pay, Apple Pay, Trustly.įees: Transfer fees vary and depend on where you’re sending the money.

How it works: You must have an account to use WorldRemit, but signing up is free. WorldRemit has some of the lowest cash transfer fees, and users can send money to people in over 130 countries. In fact, even some exchange rates used differ from service to service. When picking a service to send cash internationally, it’s important to pay attention to exchange rates and fees-not every service charges the same amount. Customers whose banks have not partnered with Zelle and who are using the service via its smartphone apps, can only send $500 per week. Transaction limits: Depends on the sender’s bank or credit union. Speed: Recipients already enrolled with Zelle will receive funds in “a matter of minutes,” according to the company. Payment options: You can only send money directly from your bank account with Zelle.įees: $0 to send or receive money (Zelle recommends confirming with your bank or credit union that it doesn’t charge additional fees to use the service.)

PAYPAL FEE ANDROID

If your bank isn’t currently partnering with Zelle, you can still use the service through its Android and iOS apps (but the recipient must bank with an institution partnering with Zelle). How it works: Customers must sign up with Zelle directly, which can often be done from their own bank’s app or website, and enroll their profile. Some 1.8 billion transactions were completed on Zelle during 2021, accounting for $490 billion in transfers. Nearly 10,000 financial institutions are now on the Zelle Network-meaning a significant number of people have access to fast, fee-free bank transfers. If you need to send money to someone, but don’t care about the added bonus of being able to pay directly from an app (like PayPal), Zelle is a great peer-to-peer tool for bank account transfers. Transaction limits: Verified accounts have no limit for the total money that can be sent, but are limited to up to $60,000 (or sometimes $10,000) in a single transaction. Speed: Funds may be received as soon as instantly in the recipient’s PayPal balance and can be transferred to their bank account as soon as the next day. Payment options: Bank account (no extra fee), credit and debit cards (small fee to send money from these options).įees: Sending money internationally to family and friends via a PayPal balance, linked bank account or a credit or debit card is subject to a charge of 5% of the amount sent, with $0.99 as the minimum fee and $4.99 as the maximum. Account holders can send money through a variety of payment methods recipients also must be PayPal account holders but can sign up for free. How it works: PayPal account holders can send money to friends and family through the app, or online via a web browser. It also allows for the largest transfers amount with no limit to how much you can send in total (but individual transactions are limited to $10,000). PayPal’s international transfers come with hefty fees, so it’s better for sending money within the U.S. Funds may be received instantly into a recipient’s PayPal account and can then be transferred to a bank account as soon as the next day.Īnother major advantage of PayPal is that if a recipient doesn’t want to link to a bank account, they can use their PayPal balance to spend money instead, because the platform is widely accepted as a method of payment.

PAYPAL FEE PLUS

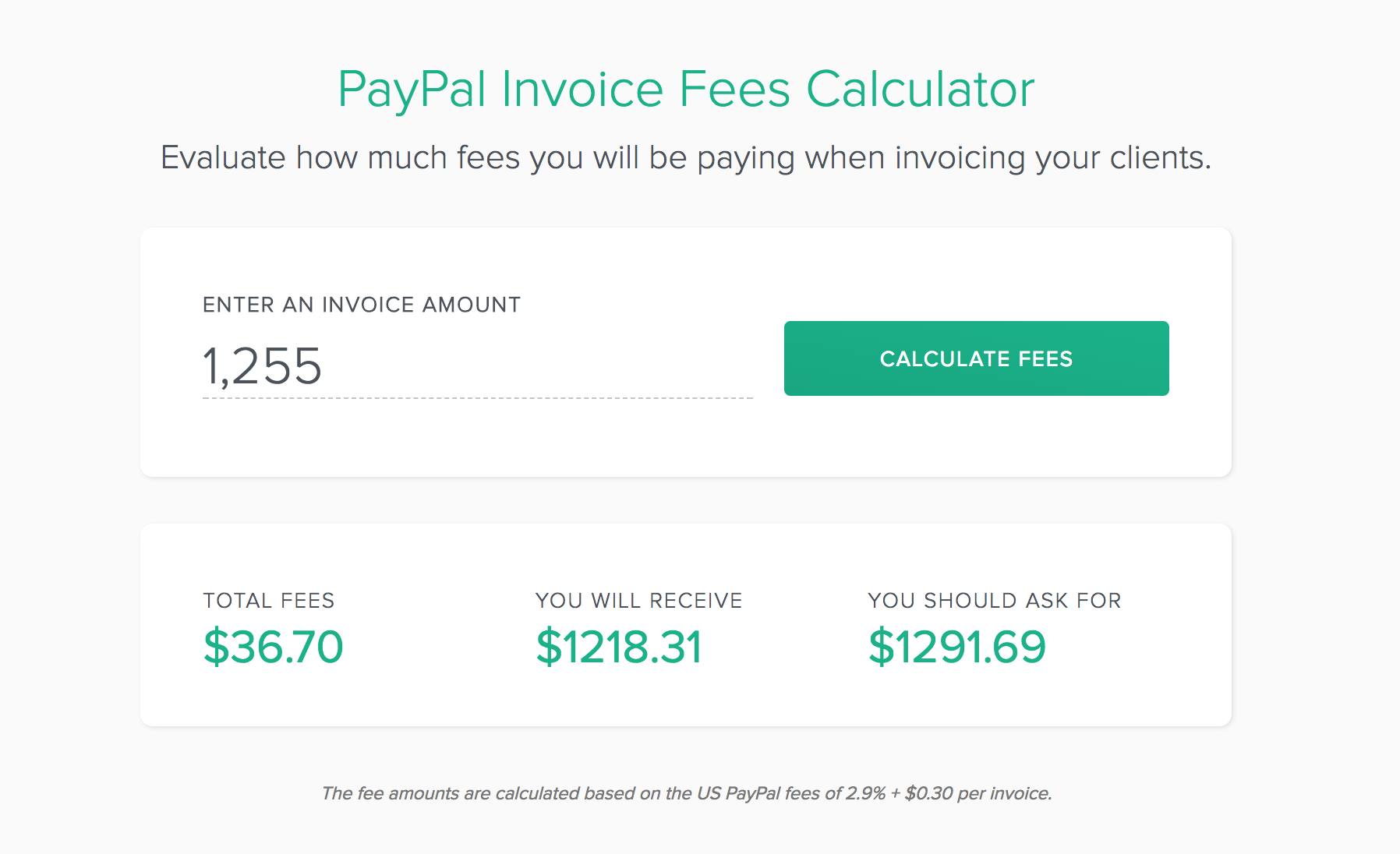

PayPal charges 3.4%, plus fixed costs of €0.35 per transaction.

0 kommentar(er)

0 kommentar(er)